do nonprofits pay taxes on rental income

For instance HOAs that file this form experience a lower tax rate 15 for the first 50000 of net income. In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of.

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Yes nonprofits must pay federal and state.

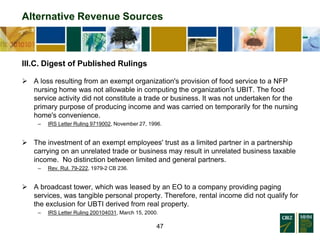

. However here are some factors to consider. Report rental income on your return for the year you. Exempt nonprofits generally do not have to pay taxes on their incomes but some types of income are taxable.

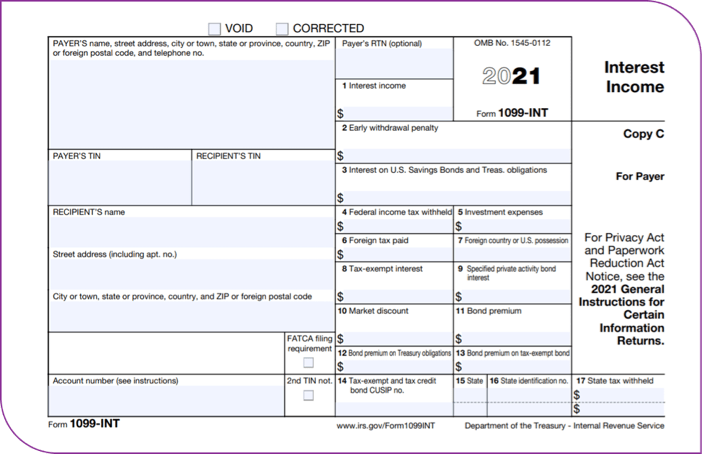

Depending on the circumstances the rental income might be considered. Do nonprofit organizations have to pay taxes. If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return.

Yes nonprofits must pay federal and state payroll taxes. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. But nonprofits still have to.

But some businesses use the accrual method of accounting. On the downside though it subjects. If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000.

June 30 2021. How to Report Taxes on Rental Income. And while churches are not allowed to.

While most nonprofits do have exempt status they can still be subject to tax if they have unrelated business taxable income UBTI. But some businesses use the accrual method of accounting. First and foremost they arent required to pay federal income taxes.

Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items.

There are clear rules as well as several exceptions to. While most US. Most nonprofits do not have to pay federal or state income taxes.

The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not substantially related to the. Did you know that sometimes nonprofits must pay income tax. Churches and religious organizations are almost always nonprofits organized under Section 501 c 3 of the Internal Revenue Code.

Did you know that sometimes nonprofits must pay income tax. Your recognition as a 501 c 3 organization exempts you from federal income tax. To file your rental income youll use Form 1040 and attach Schedule E.

UBTI is subject to unrelated business income tax. When the IRS reclassifies rentals as not-for-profits the rental income and expenses must be reported differently than ordinary rentals resulting in a severe loss of tax. These expenses may include mortgage.

There are both pros and cons to using this form. Because churches operate to serve peoples spiritual needs foster a sense of community and undertake charity they are tax-exempt and allowed to accept tax-free donations. This method requires you to report income as you receive it and expenses as you pay them out.

Just because you have a tax-exempt status it does not mean that. This counts income when its earned not when its received. Taxable if Income from any item given in exchange for a donation that costs the.

How The Irs Defines Charitable Purpose Foundation Group

Unrelated Business Income Tax Information For Charities Other Nonpr

Ubti Reporting Requirements For Partnerships And S Corporations

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

Form 1099 For Nonprofits How And Why To Issue One Jitasa Group

Should Nonprofits Seek Profits

Fillmore County Business Relief Grants Now Available

Volunteer Income Tax Assistance Vita Nonprofit Charity Donations United Way Of Tucson And Southern Arizona

Unrelated Business Income Tax Ubit A Comprehensive Overview For Nonprofits Business Law Today From Aba

How A Subsidiary 501 C 2 Could Lower Risk For Your Nonprofit Foundation Group

Nonprofit Organizations Virginia Tax

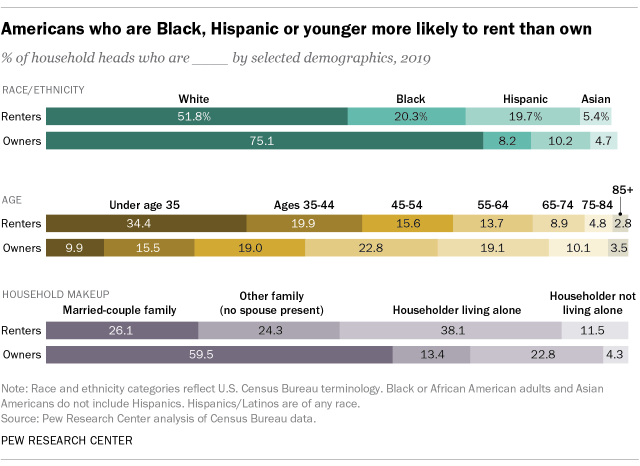

Who Rents And Who Owns In The U S Pew Research Center

Best Rental Property Spreadsheet Template For Download Monday Com Blog

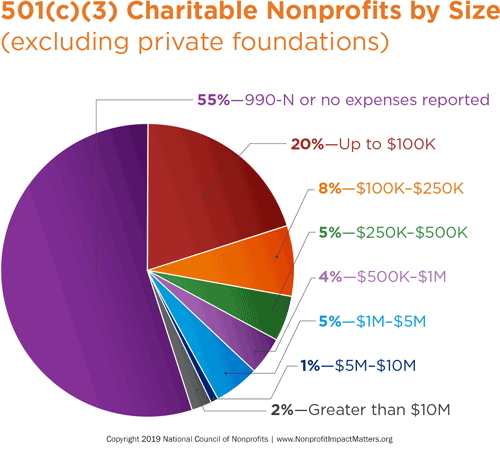

Myths About Nonprofits National Council Of Nonprofits

How Can A 501 C 3 Rent Property

Irs Form 990 Filing Instructions And Requirements For Nonprofits

Best Rental Property Spreadsheet Template For Download Monday Com Blog

:max_bytes(150000):strip_icc():gifv()/PassiveIncomeV2-655c2a09951a493ebaf3ce2d6df3ad0a.png)